Is There A State Income Tax In Idaho . One important thing to know about idaho. Find out how much you'll pay in idaho state income taxes given your annual income. Individual income tax rate schedule. Idaho moved to a flat income tax rate this year. It’s important to note that. Social security benefits aren't subject to idaho state tax, but the state may tax other types. Personal income tax rates in idaho are based on your income and filing status. In idaho, income tax rates range from 1 to 6.5 percent. The income tax rate for 2023 is 5.8% on idaho taxable income. Currently, there are seven income tax brackets in idaho, with rates ranging from 1.125% to 6.925%. See tax rate schedules for past years. Calculate your tax rate based upon your taxable income (the first two. Customize using your filing status, deductions, exemptions and more. Istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the.

from www.formsbank.com

Currently, there are seven income tax brackets in idaho, with rates ranging from 1.125% to 6.925%. Individual income tax rate schedule. Calculate your tax rate based upon your taxable income (the first two. Find out how much you'll pay in idaho state income taxes given your annual income. The income tax rate for 2023 is 5.8% on idaho taxable income. One important thing to know about idaho. See tax rate schedules for past years. Idaho moved to a flat income tax rate this year. Personal income tax rates in idaho are based on your income and filing status. It’s important to note that.

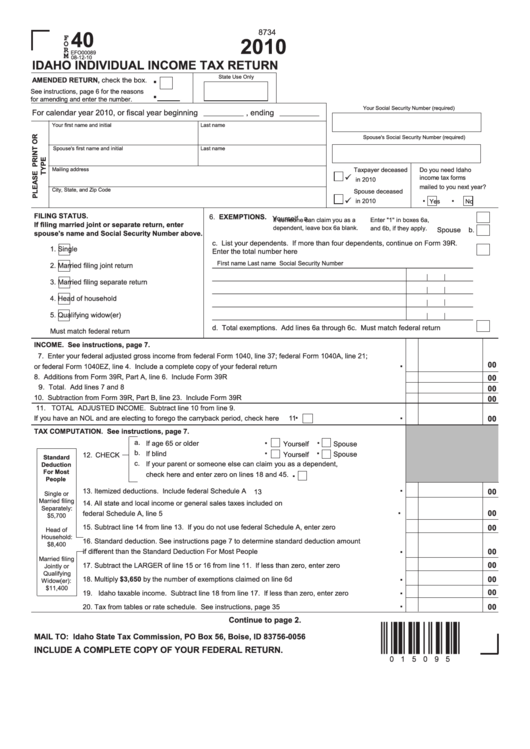

Form 40 Idaho Individual Tax Return 2010 printable pdf download

Is There A State Income Tax In Idaho It’s important to note that. Currently, there are seven income tax brackets in idaho, with rates ranging from 1.125% to 6.925%. Individual income tax rate schedule. One important thing to know about idaho. Customize using your filing status, deductions, exemptions and more. It’s important to note that. In idaho, income tax rates range from 1 to 6.5 percent. The income tax rate for 2023 is 5.8% on idaho taxable income. Istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the. Personal income tax rates in idaho are based on your income and filing status. Find out how much you'll pay in idaho state income taxes given your annual income. Calculate your tax rate based upon your taxable income (the first two. Social security benefits aren't subject to idaho state tax, but the state may tax other types. Idaho moved to a flat income tax rate this year. See tax rate schedules for past years.

From russellinvestments.com

How Can State Taxes Impact Investments? Russell Investments Is There A State Income Tax In Idaho Individual income tax rate schedule. In idaho, income tax rates range from 1 to 6.5 percent. One important thing to know about idaho. Personal income tax rates in idaho are based on your income and filing status. Calculate your tax rate based upon your taxable income (the first two. See tax rate schedules for past years. Idaho moved to a. Is There A State Income Tax In Idaho.

From www.signnow.com

Idaho State Tax 20222024 Form Fill Out and Sign Printable PDF Is There A State Income Tax In Idaho Idaho moved to a flat income tax rate this year. Individual income tax rate schedule. In idaho, income tax rates range from 1 to 6.5 percent. Calculate your tax rate based upon your taxable income (the first two. See tax rate schedules for past years. It’s important to note that. Personal income tax rates in idaho are based on your. Is There A State Income Tax In Idaho.

From www.dochub.com

Idaho tax Fill out & sign online DocHub Is There A State Income Tax In Idaho See tax rate schedules for past years. The income tax rate for 2023 is 5.8% on idaho taxable income. Currently, there are seven income tax brackets in idaho, with rates ranging from 1.125% to 6.925%. In idaho, income tax rates range from 1 to 6.5 percent. Personal income tax rates in idaho are based on your income and filing status.. Is There A State Income Tax In Idaho.

From usafacts.org

Which states have the highest and lowest tax? USAFacts Is There A State Income Tax In Idaho Personal income tax rates in idaho are based on your income and filing status. Currently, there are seven income tax brackets in idaho, with rates ranging from 1.125% to 6.925%. Find out how much you'll pay in idaho state income taxes given your annual income. One important thing to know about idaho. See tax rate schedules for past years. Social. Is There A State Income Tax In Idaho.

From www.dochub.com

Idaho tax Fill out & sign online DocHub Is There A State Income Tax In Idaho The income tax rate for 2023 is 5.8% on idaho taxable income. Find out how much you'll pay in idaho state income taxes given your annual income. It’s important to note that. Istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the. Individual income tax rate schedule. Calculate. Is There A State Income Tax In Idaho.

From www.youtube.com

File Idaho tax returns starting Monday YouTube Is There A State Income Tax In Idaho See tax rate schedules for past years. Customize using your filing status, deductions, exemptions and more. The income tax rate for 2023 is 5.8% on idaho taxable income. One important thing to know about idaho. Personal income tax rates in idaho are based on your income and filing status. Find out how much you'll pay in idaho state income taxes. Is There A State Income Tax In Idaho.

From www.mortgagerater.com

Idaho Tax Rates Explored Is There A State Income Tax In Idaho Find out how much you'll pay in idaho state income taxes given your annual income. Currently, there are seven income tax brackets in idaho, with rates ranging from 1.125% to 6.925%. In idaho, income tax rates range from 1 to 6.5 percent. Customize using your filing status, deductions, exemptions and more. The income tax rate for 2023 is 5.8% on. Is There A State Income Tax In Idaho.

From us.icalculator.info

Idaho State Tax Tables 2022 US iCalculator™ Is There A State Income Tax In Idaho Currently, there are seven income tax brackets in idaho, with rates ranging from 1.125% to 6.925%. It’s important to note that. Personal income tax rates in idaho are based on your income and filing status. Idaho moved to a flat income tax rate this year. Social security benefits aren't subject to idaho state tax, but the state may tax other. Is There A State Income Tax In Idaho.

From idahocapitalsun.com

Want to track your 2022 tax rebate? Check out this tool from the Idaho Is There A State Income Tax In Idaho The income tax rate for 2023 is 5.8% on idaho taxable income. Idaho moved to a flat income tax rate this year. Istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the. Find out how much you'll pay in idaho state income taxes given your annual income. Social. Is There A State Income Tax In Idaho.

From idahocapitalsun.com

Qualified for a 2021 Idaho tax return extension? Your deadline Is There A State Income Tax In Idaho Find out how much you'll pay in idaho state income taxes given your annual income. Istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the. Social security benefits aren't subject to idaho state tax, but the state may tax other types. Currently, there are seven income tax brackets. Is There A State Income Tax In Idaho.

From tax.idaho.gov

File Idaho tax returns starting Jan. 29 Idaho State Tax Commission Is There A State Income Tax In Idaho Individual income tax rate schedule. One important thing to know about idaho. Istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the. Social security benefits aren't subject to idaho state tax, but the state may tax other types. The income tax rate for 2023 is 5.8% on idaho. Is There A State Income Tax In Idaho.

From chrisbanescu.com

Top State Tax Rates for All 50 States Chris Banescu Is There A State Income Tax In Idaho Individual income tax rate schedule. Idaho moved to a flat income tax rate this year. Find out how much you'll pay in idaho state income taxes given your annual income. See tax rate schedules for past years. Currently, there are seven income tax brackets in idaho, with rates ranging from 1.125% to 6.925%. Personal income tax rates in idaho are. Is There A State Income Tax In Idaho.

From www.formsbirds.com

Individual Tax Return Idaho Free Download Is There A State Income Tax In Idaho Personal income tax rates in idaho are based on your income and filing status. Calculate your tax rate based upon your taxable income (the first two. Social security benefits aren't subject to idaho state tax, but the state may tax other types. One important thing to know about idaho. The income tax rate for 2023 is 5.8% on idaho taxable. Is There A State Income Tax In Idaho.

From www.pinterest.com

Idaho state and local taxburden > manufacturing, educational services Is There A State Income Tax In Idaho Individual income tax rate schedule. The income tax rate for 2023 is 5.8% on idaho taxable income. Find out how much you'll pay in idaho state income taxes given your annual income. Personal income tax rates in idaho are based on your income and filing status. In idaho, income tax rates range from 1 to 6.5 percent. Currently, there are. Is There A State Income Tax In Idaho.

From www.formsbank.com

Fillable Form 51 Estimated Payment Of Idaho Individual Tax Is There A State Income Tax In Idaho Customize using your filing status, deductions, exemptions and more. One important thing to know about idaho. Personal income tax rates in idaho are based on your income and filing status. Find out how much you'll pay in idaho state income taxes given your annual income. Social security benefits aren't subject to idaho state tax, but the state may tax other. Is There A State Income Tax In Idaho.

From www.templateroller.com

Form 40 2017 Fill Out, Sign Online and Download Fillable PDF, Idaho Is There A State Income Tax In Idaho Social security benefits aren't subject to idaho state tax, but the state may tax other types. It’s important to note that. Customize using your filing status, deductions, exemptions and more. The income tax rate for 2023 is 5.8% on idaho taxable income. Personal income tax rates in idaho are based on your income and filing status. One important thing to. Is There A State Income Tax In Idaho.

From taxfoundation.org

How High Are Tax Rates in Your State? Tax Foundation Is There A State Income Tax In Idaho One important thing to know about idaho. Find out how much you'll pay in idaho state income taxes given your annual income. The income tax rate for 2023 is 5.8% on idaho taxable income. Istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the. Calculate your tax rate. Is There A State Income Tax In Idaho.

From support.joinheard.com

Paying State Tax in Idaho Heard Is There A State Income Tax In Idaho Calculate your tax rate based upon your taxable income (the first two. In idaho, income tax rates range from 1 to 6.5 percent. It’s important to note that. One important thing to know about idaho. Istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the. Personal income tax. Is There A State Income Tax In Idaho.